Shares of Patanjali Foods on Lower Circuit Today

Patanjali Foods

Patanjali Foods, formerly known as Ruchi Soya, underwent an acquisition by Patanjali Ayurveda through the insolvency process. As a result of this transaction, the public shareholding of Patanjali Foods reduced to 1.10 percent.

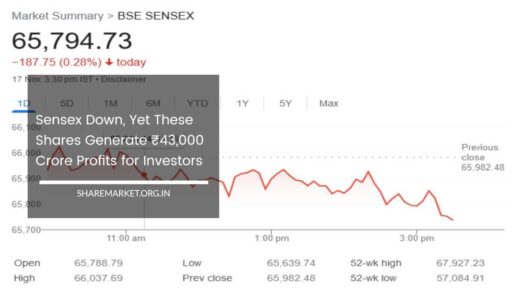

In recent stock market news, the domestic equity benchmark index BSE Sensex reached a significant milestone by crossing the 66,000 level for the first time.

However, the shares of Patanjali Foods experienced a decline and triggered the lower circuit, which means there were no buyers available for the shares on that particular day.

On the Bombay Stock Exchange (BSE), the shares of Patanjali Foods recorded a 5 percent decrease, trading at Rs 1166.65 (Patanjali Foods Share Price).

The decline in share price can be attributed to the pricing strategy adopted by the company for the Offer for Sale (OFS).

Patanjali Foods set the offer for sale (OFS Price) at Rs 1,000, which represents a discount of approximately 19 percent from the closing price of Rs 1,228.05 on the previous day, Wednesday.

The decision to fix the offer for sale at a discounted price may have influenced the decrease in the share price of Patanjali Foods.

It is important to note that stock market dynamics and investor sentiment can impact share prices, and fluctuations are a common occurrence. Investors should carefully consider the factors influencing a company’s performance before making investment decisions.

Patanjali Foods OFS Details

Patanjali Foods has released details regarding its Offer for Sale (OFS) in which the company’s promoters plan to sell 2.53 crore shares, representing approximately 9 percent of their stake in the company. The fixed price for this offer is set at Rs 1,000 per share.

The OFS is currently open to non-retail investors, and it will be open to retail investors starting tomorrow, July 14. The base size for the offer is 2,53,39,640 equity shares, which corresponds to 7 percent of the promoters’ holding in the company.

It is worth noting that if the demand exceeds expectations, there is a provision for additional shares to be sold. This means that an additional 72.39 lakh shares can be made available, enabling the promoters to reduce their stake by an additional 9 percent.

The OFS presents an opportunity for investors, both retail and non-retail, to acquire shares of Patanjali Foods.

However, it is important for potential investors to carefully analyze the company’s financials, market conditions, and any relevant industry trends before making investment decisions.

Why Are the Promoters of Patanjali Foods Selling Shares?

The promoters of Patanjali Foods have decided to sell shares in order to comply with the market regulations set by the Securities and Exchange Board of India (SEBI).

According to the shareholding pattern for the June 2023 quarter, the promoters currently hold a significant stake of 80.82 percent in the company, with Patanjali Ayurveda owning 39.37 percent.

However, as per SEBI’s rules, companies listed on the stock market are required to have at least 25 percent of their shareholding held by the public, limiting the promoters’ maximum ownership to 75 percent. Failure to meet this minimum requirement can lead to regulatory consequences.

In the case of Patanjali Foods, which was previously known as Ruchi Soya, the company underwent an acquisition by Patanjali Ayurveda as part of the bankruptcy process.

This acquisition resulted in a significant reduction in the company’s public shareholding, which currently stands at 1.10 percent.

To rectify the situation and meet the SEBI requirements, the promoters have opted to sell a portion of their stake through the Offer for Sale (OFS).

This will allow them to reduce their ownership percentage and increase the public shareholding, thereby aligning with the regulatory guidelines.

By selling shares, the promoters aim to bring the public shareholding to the stipulated minimum level and ensure compliance with SEBI regulations.

It is important to note that such actions are common when companies need to adhere to regulatory norms and maintain a balanced ownership structure.