Stock Market Analysis Techniques

Stock Market Analysis Techniques

Stock Market Analysis Techniques for the Savvy Indian Investor

India’s burgeoning stock market pulsates with opportunity, attracting investors seeking a piece of its dynamic growth. Yet, navigating its complexities can feel like deciphering an ancient script.

Here’s where stock market analysis techniques come in, empowering you to make informed decisions and unlock your financial potential.

This comprehensive guide delves into the two primary analysis methods – fundamental analysis and technical analysis – with a keen eye on the Indian market landscape.

Understanding the Indian Stock Market Terrain

India’s stock market is a vibrant tapestry woven with established giants and innovative startups. It boasts the world’s fastest growth rates, but remains susceptible to global economic tides and local regulations.

To effectively analyze Indian stocks, it’s crucial to consider these factors alongside the analysis techniques explored below.

The Bedrock of Investment: Fundamental Analysis

Fundamental analysis is the meticulous study of a company’s intrinsic value. It aims to assess whether the current stock price accurately reflects its future potential. Indian investors wielding this approach should meticulously examine the following:

- Financial Statements: These are the cornerstones of financial health. The balance sheet reveals a company’s assets, liabilities, and shareholder equity, providing a snapshot of its financial position. The income statement details its revenue, expenses, and net profit, offering insights into profitability. Finally, the cash flow statement highlights how the company generates and utilizes cash, a crucial indicator of its operational efficiency. By analyzing these statements, you gain a comprehensive understanding of the company’s financial stability, growth potential, and ability to generate sustainable profits.

Beyond the Company Walls: Industry Analysis

A company doesn’t operate in a vacuum. Evaluating the industry’s overall health and growth trajectory is essential for Indian investors. Look for trends that could impact the company’s performance, such as:

- Technological advancements: Is the industry undergoing a digital transformation? How will this impact the company’s products, services, and competitive edge?

- Regulatory landscape: Are there any upcoming regulations that could affect the industry’s profitability?

- Competitive landscape: Who are the key players in the industry? How is the company positioned against its competitors?

- Demand dynamics: Is there a growing demand for the industry’s products or services? Are there any potential disruptions to the demand chain?

By understanding these industry trends, you can make informed investment decisions about companies poised for success within their specific market niche.

The Guiding Hand: Management Analysis

The quality and experience of a company’s leadership team significantly influence its trajectory. Here’s what Indian investors should delve into:

- Track Record: Has the management team delivered strong financial performance in the past? Do they have a proven ability to navigate challenging market conditions?

- Vision and Strategy: What is the company’s vision for the future? Does the management team have a clear and well-defined strategy to achieve its goals?

- Corporate Governance: Does the company adhere to sound corporate governance principles? Is there transparency in its operations and decision-making processes?

By scrutinizing the management team, you gain confidence in their ability to steer the company towards long-term growth and shareholder value creation.

The Macroeconomic Pulse: Considering the Bigger Picture

The Indian economy is intricately linked to its stock market. Here are some key macroeconomic factors Indian investors should consider:

- Inflation: Rising inflation erodes the purchasing power of future profits. Understanding inflation trends helps you assess the company’s ability to maintain its profit margins.

- Interest Rates: Higher interest rates can make it more expensive for companies to borrow money and invest in growth initiatives. Conversely, lower interest rates can stimulate economic activity and potentially benefit companies.

- Government Policies: Government policies regarding taxation, infrastructure development, and foreign investment can significantly impact the stock market and specific sectors.

By staying abreast of these macroeconomic factors, you can anticipate potential impacts on your investments and make informed decisions.

Resources for Fundamental Analysis in India:

- Annual reports of companies listed on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) are readily available online.

- Reputable financial institutions like CRISIL and ICRA publish detailed industry reports that provide valuable insights.

- Analyst ratings and research reports offered by leading brokerage firms can be a valuable resource, although it’s crucial to consider potential biases.

Technical Analysis: Reading the Market’s Tea Leaves

Technical analysis focuses on historical price movements, trading volume, and chart patterns to identify potential future trends. This method is particularly helpful for short-term trading decisions in the Indian market. Here’s what Indian investors should be familiar with:

- Chart Patterns: Technical analysts identify recurring chart patterns like head and shoulders, double tops, and breakout patterns that may signal potential price movements. Recognizing these patterns can help you anticipate potential entry and exit points for your investment decisions in the stock market.

- Technical Indicators: These are mathematical calculations based on historical price and volume data that can provide insights into market sentiment, momentum, and potential trend reversals. Popular technical indicators in the Indian context include:

- Moving Average Convergence Divergence (MACD): This indicator helps identify potential trend changes by measuring the relationship between two moving averages of a stock’s price.

- Relative Strength Index (RSI): This indicator measures the speed and magnitude of recent price movements, helping to identify potential overbought or oversold conditions.

- Bollinger Bands: These bands represent a range of volatility around a stock’s moving average. When the bands widen, it may indicate increased volatility, while narrowing bands may suggest a period of consolidation.

While technical indicators can be helpful, it’s crucial to remember that they are not foolproof. They should be used in conjunction with other analysis techniques and a healthy dose of skepticism.

- Trading Volume: Analyzing trading volume alongside price movements can provide valuable insights. High volume during price increases suggests strong buying pressure, potentially indicating a bullish trend. Conversely, high volume during price declines may indicate selling pressure, potentially signaling a bearish trend.

Resources for Technical Analysis in India:

- Many online brokers offer stock charting software with a variety of technical indicators and tools.

- Indian financial institutions often conduct technical analysis courses and webinars that can equip you with the necessary skills.

Combining Techniques for a Holistic Approach

Fundamental and technical analysis offer distinct perspectives on the stock market. The most successful Indian investors often leverage a combination of both approaches.

Fundamental analysis helps you identify companies with strong long-term potential, while technical analysis can guide your entry and exit points for maximizing returns within that timeframe. Here’s how to effectively integrate these techniques:

- Start with Fundamentals: Begin by identifying companies with sound financials, strong management, and promising growth prospects within a healthy industry.

- Refine with Technicals: Once you’ve shortlisted companies, use technical analysis to identify potential entry and exit points based on chart patterns, technical indicators, and trading volume.

Beyond Analysis: Essential Considerations for Indian Investors

- Regulation and Taxation: Stay updated on regulatory changes and tax implications that can affect your investment decisions. For instance, changes in dividend taxation or short-term capital gains tax can impact your investment strategies.

- Risk Management: Develop a sound risk management strategy to mitigate potential losses. This includes using stop-loss orders to automatically exit a position if the price falls below a certain level and diversifying your portfolio across different sectors and asset classes.

- Investment Horizon: Clearly define your investment horizon (short-term, medium-term, or long-term) to tailor your analysis approach accordingly. Technical analysis is often more suited for short-term trading, while fundamental analysis is crucial for long-term investment decisions.

Beyond the Basics: Advanced Techniques for the Discerning Investor

While the core principles of fundamental and technical analysis provide a solid foundation, there’s a world of advanced techniques waiting to be explored by the discerning Indian investor. Here are some additional avenues to consider:

Fundamental Analysis – Delving Deeper

- Discounted Cash Flow (DCF) Analysis: This method estimates the intrinsic value of a company by calculating the present value of its future cash flows. By factoring in factors like growth rate and discount rate, DCF analysis can help you assess if a stock is currently undervalued or overvalued.

- Valuation Ratios: Financial ratios like Price-to-Earnings (P/E) ratio, Price-to-Book (P/B) ratio, and Enterprise Value-to-EBITDA (EV/EBITDA) ratio can help you compare companies within the same industry and assess their relative value. However, it’s crucial to consider these ratios in conjunction with other factors and industry benchmarks.

- Competitive Advantage Analysis: Understanding a company’s competitive advantage is critical for long-term investment success. Look for companies with strong brand recognition, intellectual property rights, efficient cost structures, or a dominant market share.

Technical Analysis – Refining Your Skills

- Advanced Chart Patterns: Beyond basic patterns like head and shoulders, technical analysts utilize more complex formations like cup and handle, flags, and wedges to identify potential trend continuations or reversals.

- Candlestick Charts: These charts offer a more detailed picture of price movements compared to traditional bar charts. By analyzing the color and size of the candlesticks (representing opening, high, low, and closing prices), you can gain deeper insights into market sentiment and potential turning points.

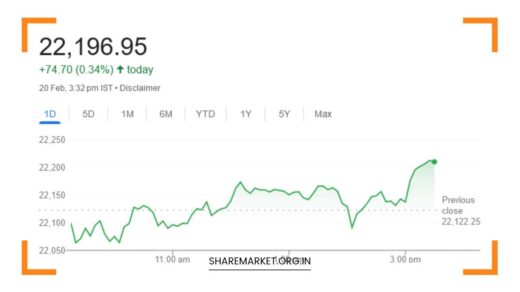

- Market Indicators: In addition to individual stock analysis, technical analysts also use broader market indicators like the Nifty 50 or sectoral indices to gauge overall market sentiment and identify potential trading opportunities.

Beyond Fundamentals and Technicals: Additional Considerations

- Behavioral Finance: Understanding how investor psychology and emotions can influence market movements can provide valuable insights, particularly for short-term trading decisions.

- Sector Rotation: Market trends can favor certain sectors at different times. By understanding sector rotation and analyzing sectoral performance, you can adjust your portfolio allocation to capitalize on these trends.

- Event-Driven Investing: Certain events like mergers and acquisitions, policy changes, or earnings announcements can significantly impact stock prices. By staying informed about upcoming events and their potential implications, you can identify short-term trading opportunities.

Remember: Advanced techniques are powerful tools, but they require a deeper understanding of the market and a commitment to continuous learning.

The Evolving Landscape: Staying Ahead of the Curve

The Indian stock market is constantly evolving, influenced by technological advancements, regulatory changes, and global economic trends. Here are some ways to stay ahead of the curve:

- Follow Reputable Financial News Sources: Regularly stay updated on market news, company announcements, and economic data.

- Utilize Online Resources: Numerous online resources offer valuable insights on the Indian market, including investment blogs, financial news websites, and research reports.

- Attend Investor Education Seminars: Many financial institutions and brokerages conduct investor education seminars that can equip you with the latest knowledge and strategies.

Final Remarks: A Lifelong Journey of Learning

Stock market analysis is not a destination, but a lifelong journey of learning and refinement. By continuously honing your skills, staying updated on market trends, and applying a combination of fundamental, technical, and advanced analysis techniques, you can empower yourself to make informed investment decisions and navigate the dynamic Indian market with greater confidence.

Remember, discipline, patience, and a healthy dose of skepticism are your allies in this exciting and ever-evolving investment landscape.

Disclaimer: This blog post is for informational purposes only and should not be considered financial advice. Please consult with a qualified financial advisor before making any investment decisions.