Tejas Networks Receives Rs 750 Crore Advance from TCS, Shares Soar to One-Year Record High

Tejas Networks

Tejas Networks Shares Soar to One-Year High After Rs 750 Crore Advance from TCS

The stock market is no stranger to volatility, with share prices of companies often influenced by a myriad of factors, ranging from economic indicators to corporate developments.

One such development that recently sent ripples through the market was the significant surge in Tejas Networks’ share price.

This surge catapulted the stock to a one-year high during the trading session on Friday, September 8, 2023. The trigger behind this remarkable increase in the company’s stock price was the news of Tejas Networks receiving an advance amount of Rs 750 crore from Tata Consultancy Services (TCS).

While the market rejoiced in the wake of this financial infusion, it’s imperative to delve deeper into the intricacies of this development, understand the context in which it occurred, and assess its implications for Tejas Networks and its investors.

The Tejas Networks Share Price Surge:

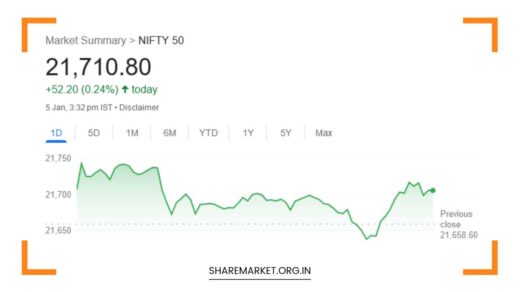

The surge in Tejas Networks’ share price was undoubtedly the headline-grabbing event of the trading day. During the course of the day’s trading, shares of Tejas Networks witnessed a notable upswing, rallying by approximately 4.5 percent.

This surge was particularly significant because it propelled the company’s shares to their highest level in the past year.

Such an uptick in stock price not only reflects strong market sentiment but also underscores the confidence investors place in Tejas Networks’ prospects and strategic initiatives.

However, it’s worth noting that the market’s response to this development wasn’t uniform throughout the trading day. While the surge in share price created a buzz, Tejas Networks’ shares eventually experienced a slight correction as the trading day drew to a close.

Ultimately, they settled at Rs 894 per share, marking a modest increase of 0.067 percent from the previous trading day’s closing price.

The Catalyst: TCS’s Rs 750 Crore Advance:

So, what exactly caused this surge in Tejas Networks’ share price? The catalyst behind this market excitement was the news of Tata Consultancy Services (TCS) extending an advance payment of Rs 750 crore to Tejas Networks.

This substantial financial transaction was in connection with a significant contract that Tejas Networks had secured—a contract that held the promise of transforming the company’s fortunes.

This contract pertains to the supply of Radio Access Network Equipment for Bharat Sanchar Nigam Limited (BSNL)’s 4G/5G network deployment across India. It’s a noteworthy deal with far-reaching implications for Tejas Networks’ operations and growth trajectory.

The BSNL Contract: A Game-Changer for Tejas Networks:

In August, Tejas Networks emerged victorious in securing a pivotal contract from Tata Consultancy Services (TCS).

This contract entailed the supply, support, and annual maintenance services of radio access network equipment for BSNL’s extensive 4G/5G network expansion plan, which encompasses approximately 1,00,000 sites across India. The total order value for this monumental contract is an impressive Rs 7,492 crore, setting the stage for substantial growth opportunities for Tejas Networks.

The contract’s terms outline Tejas Networks’ responsibilities, with the company tasked with supplying the network equipment during the years 2023 and 2024.

Additionally, Tejas Networks is committed to providing comprehensive support and maintenance services for an extended duration of nine years, commencing after the expiration of the warranty period.

A Closer Look at Tejas Networks:

Tejas Networks, headquartered in Bengaluru, India, is a prominent player in the wireless telecom and data networking products industry.

The company has established a strong presence in both domestic and international markets, offering a range of innovative solutions in the telecommunications space.

Challenges in the Recent Financial Quarter:

While the recent surge in Tejas Networks’ share price and the contract with TCS have fueled optimism, it’s crucial to acknowledge the challenges the company faced in its financial performance for the June quarter.

During this period, Tejas Networks reported a net loss of Rs 26.3 crore, marking a significant increase compared to the loss of Rs 11.5 crore reported in the previous quarter.

Furthermore, the company had recorded a loss of Rs 6.6 crore during the same quarter the previous year.

The financial challenges were also reflected in the quarterly revenue figures, which exhibited a decline of 37.2 percent, amounting to Rs 188 crore. However, when viewed on an annual basis, the revenue showed a robust increase of 46 percent.

These financial hurdles were attributed to several factors, including ongoing investments in Research and Development (R&D), a charge of Rs 31.3 crore for Employee Stock Ownership Plans (ESOP), fees, and an increase in component costs due to accelerated spot purchases.

Strength in the Order Book:

Despite the financial challenges in the June quarter, Tejas Networks maintained a robust order book valued at Rs 1,909 crore.

What’s particularly encouraging is that a significant portion of this order book, estimated at 50-60 percent, is expected to be completed by the end of the current fiscal year.

This strong order pipeline underscores the company’s potential for future growth and business expansion.

Investment Considerations:

The Tejas Networks story, while marked by challenges, presents an intriguing investment opportunity for those willing to look beyond short-term fluctuations. Here are key considerations for potential investors:

- Financial Performance: Tejas Networks’ recent financial challenges should be examined in the context of its long-term growth prospects. Investors should meticulously analyze the company’s financial statements and consider consulting financial experts to assess the sustainability of its growth.

- Contract Impact: The TCS contract for BSNL’s network expansion is a game-changer for Tejas Networks. Investors should closely monitor the implementation and execution of this contract, as it is expected to significantly impact the company’s future revenue and profitability.

- Market Potential: The telecommunications industry, particularly the demand for network equipment and solutions, remains robust. Tejas Networks’ contract with BSNL positions it favorably to capitalize on this demand.

- Competitive Landscape: Understanding the competitive landscape in the telecommunications and networking products industry is crucial. Investors should assess how Tejas Networks differentiates itself from competitors and its strategies for sustained growth.

- Management Expertise: The expertise and experience of the company’s management team play a pivotal role in its success. Investigate the backgrounds of key executives to gain confidence in their ability to navigate the industry.

- IPO Valuation: Evaluate the IPO pricing within the context of the company’s financials and industry benchmarks. An IPO should offer fair value to investors.

- Long-Term Vision: Consider Tejas Networks’ long-term vision and strategies for growth, including its expansion plans and initiatives to strengthen its market position.

Final Words:

The surge in Tejas Networks’ share price following the advance payment from TCS and the significant contract win with BSNL highlights the market’s recognition of the company’s strategic initiatives and growth prospects.

While the recent financial results showed losses, the company’s strong order book and long-term contracts position it favorably for future revenue generation.

Investors and industry observers will closely monitor Tejas Networks’ financial performance in the coming quarters, particularly in light of its commitments under the BSNL contract.

Additionally, the company’s ability to manage costs and successfully execute its projects will be essential factors in its journey toward sustainable profitability.

Investing in a company undergoing transformative phases such as contract wins and expansion plans carries inherent risks.

It’s important for investors to align their investment strategy with their financial goals and risk tolerance. While the gray market can provide an initial indication of market sentiment, it’s essential to base investment decisions on a comprehensive assessment of the company’s fundamentals and outlook.

As Tejas Networks continues on its path of growth and expansion, investors have the opportunity to evaluate this investment prospect diligently and determine whether it aligns with their investment objectives.

In the world of stock markets, where optimism and caution often dance hand in hand, informed decisions pave the way for sustainable investments.